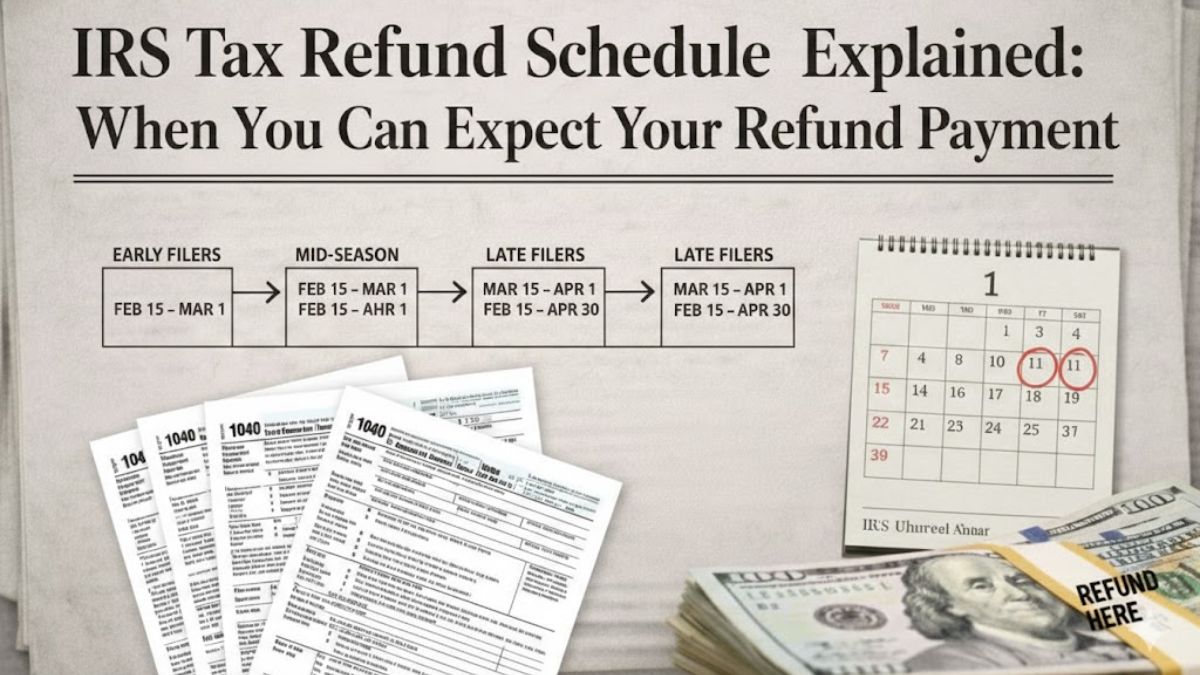

IRS Tax Refund Schedule Explained: The 2026 tax filing season has officially started, and millions of Americans are focused on one major concern: when their tax refund will arrive. For many households, a refund is more than just extra money. It plays an important role in managing monthly expenses, paying off bills, reducing debt, or saving for future needs. Understanding how the IRS refund process works can help taxpayers set realistic expectations and reduce stress during the waiting period.

Tax refunds often provide a temporary financial boost that many families rely on. This makes it essential for taxpayers to be aware of timelines, procedures, and factors that can affect the arrival of their money. Being informed also helps prevent unnecessary anxiety over delays.

How the IRS Processes Tax Returns

After a tax return is submitted, it enters the IRS processing system. For electronic returns, acknowledgment usually happens within 24 hours. The IRS then reviews the return for accuracy, compares reported income with available records, and checks for potential issues, including identity verification or eligibility for refundable credits.

For most error-free returns filed electronically with direct deposit, refunds are generally issued within about 21 days. This timeline is an estimate and may vary depending on individual circumstances. Returns with missing information or errors may require additional review, which can extend the refund process.

The Role of Filing Method in Refund Speed

The way a tax return is filed has a significant impact on how quickly a refund arrives. Electronic filing combined with direct deposit is the fastest option. Digital processing reduces manual work and allows refunds to be deposited directly into bank accounts, often within three weeks.

In contrast, paper filing takes longer because each return must be handled manually. If a paper return requests a mailed check, the waiting period can extend to six weeks or more. Busy periods during tax season can further delay paper refunds. Choosing electronic filing and direct deposit is the most effective way to receive a refund quickly in 2026.

When to Expect Refunds in February 2026

Taxpayers who file early and meet all requirements often see refunds arrive during February. Many early electronic filers receive refunds in the first half of the month, while others may get them later, depending on when the return is officially accepted by the IRS. Acceptance is the key date for processing, not the day a return is submitted.

Electronic returns are usually accepted quickly, allowing them to move through the system faster. Paper returns may take several days or weeks to reach acceptance, which delays the start of processing and ultimately pushes back the refund date.

How Tax Credits Affect Refund Timing

Some refunds take longer due to refundable tax credits. Credits such as the Earned Income Tax Credit and the Additional Child Tax Credit require extra verification by law to prevent fraud. Even accurate and early-filed returns claiming these credits may experience delays, often until later in February.

Other common causes of delays include errors in personal information, incorrect bank account numbers, missing forms, or identity verification requests. Ensuring that all details are correct before submission can help avoid these issues and make refunds arrive faster.

Tracking Your Refund

The IRS provides online tools to help taxpayers monitor the status of their refunds. The “Where’s My Refund?” tool allows users to see when their return has been received, approved, and sent. It updates once every 24 hours and provides accurate information specific to each taxpayer’s return.

Even after the IRS issues a refund, bank processing may cause a small delay before the money appears in an account. Using official tools is the most reliable way to track progress and avoid confusion caused by third-party sources or unofficial timelines.

Preparing for a Smooth Refund Experience

To ensure a smoother refund process, accuracy and preparation are key. Double-checking personal details, income information, and bank account numbers can prevent avoidable delays. Filing early, choosing electronic submission, and opting for direct deposit are recommended practices.

Planning how to use the refund in advance can also reduce stress. Whether it is applied toward bills, debt, or savings, having a clear purpose for the refund makes the waiting period feel more manageable.

Common Issues That Can Delay Refunds

Refund delays are not uncommon, and they can occur for several reasons. Simple mistakes, such as incorrect Social Security numbers, mismatched names, or bank information errors, can hold up processing. Complex returns with multiple income sources, amended filings, or unusual deductions may also require manual review, adding extra days or weeks to the refund timeline.

Identity verification has become a focus in recent years, and stronger checks in 2026 may temporarily hold some refunds while the IRS confirms taxpayer information. Understanding these potential issues can help taxpayers remain patient and informed throughout the process.

What to Expect Overall in 2026

Overall, most taxpayers filing electronically with direct deposit should receive their refunds within about three weeks of acceptance. Paper filers and those claiming certain credits may experience longer timelines. Being aware of how the IRS processes returns and what can cause delays helps taxpayers manage expectations and plan their finances more effectively.

Even without a specific published schedule, the 2026 tax season is expected to follow patterns similar to previous years. Staying informed, accurate, and proactive ensures a smoother experience for everyone awaiting their refund.

The IRS refund process in 2026 is structured to provide timely returns for most taxpayers. Filing electronically, choosing direct deposit, and carefully reviewing returns can minimize delays. Refunds often arrive within three weeks for straightforward returns, though some delays are possible due to credits, verification, or errors.

Understanding the system and planning in advance allows taxpayers to navigate the season confidently, ensuring that refunds serve their intended financial purpose without unnecessary stress.

Disclaimer

This article is for general informational purposes only and does not provide legal, financial, or tax advice. Tax laws, refund timelines, and eligibility requirements may change. Taxpayers should consult official IRS guidance or a qualified tax professional for advice specific to their situation.